- Scaramucci urged Bitcoin investors not to lose sight of the big picture

- He also compared the volatility of Bitcoin during growth with the Amazon stock in the late 90s

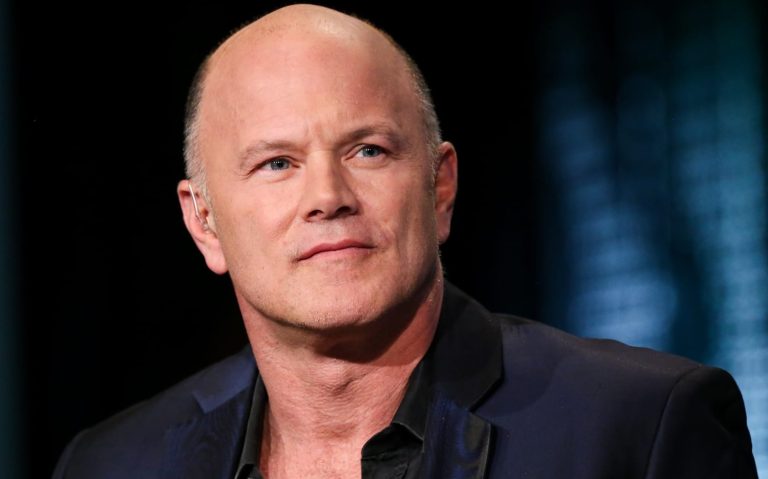

The founder of SkyBridge Capital, Anthony Scaramucci, has asked investors to hold on to their crypto assets, as he believes that the current market slump will soon come to an end.

„Take a chill pill, stick with Bitcoin and other cryptocurrencies like Algorand and Ethereum for a long time, and I think you will be very well served with these investments in the long run“, he said.

Bitcoin is not yet a mature store of value

During a CNBC-Conduct interviews he explained that the dollar will always remain the dollar, which is why the change of Bitcoin relative to it should not cause much concern among investors. He urged them to focus on the future and make long-term investments, noting that Bitcoin is an emerging technology whose role as a store of value will increase as acceptance increases.

„We overtake each other. If it’s 2025 and there are a billion Bitcoin wallets, let’s call it a currency. The dollar is still the dollar. For me, this is an emerging technology that will eventually develop into business value as more and more people join the network.“

Scaramucci also mentioned Amazon’s growth in the late ’90s, a time when stocks were subject to massive volatility, as a reason why he wouldn’t treat Bitcoin too harshly because of its volatility.

Despite a loss in value of at least 50 % in a total of eight periods, the stock of the company listed on the NASDAQ survived and is now considered one of the most valuable tickers. He postulated that investors need to realize that Bitcoin is still an early adoption technology and therefore is neither a store of value nor a currency.

„Ultimately, it’s about buying quality and realizing that Bitcoin – and I’ve said this many times on the air – is not a store of value at the moment. It’s not technically a currency at the moment“, he explained.

The acceptance of crypto will increase this year

In addition to his enthusiasm for the digital asset, Scaramucci said he recommends that his clients invest in the asset, but in reasonable amounts.

He insisted that he expects Bitcoin to maintain its upward trend. The former Goldman Sachs executive explained that although the crypto markets are still extremely unpredictable, he expects the adoption of crypto to increase this year.

In addition, he noted that any sudden collapse in the markets is nothing new for Bitcoin, and predicted that by 2024 the coin would grow to 500 million to 1 billion wallets worldwide.

„… Bitcoin, in my opinion, will have half a billion wallets, possibly a billion wallets by the time we get to 2024. So people should sit this stuff out. I think it’s nonsensical to expect only an asymmetric 45-degree line in such a new story as Bitcoin.“