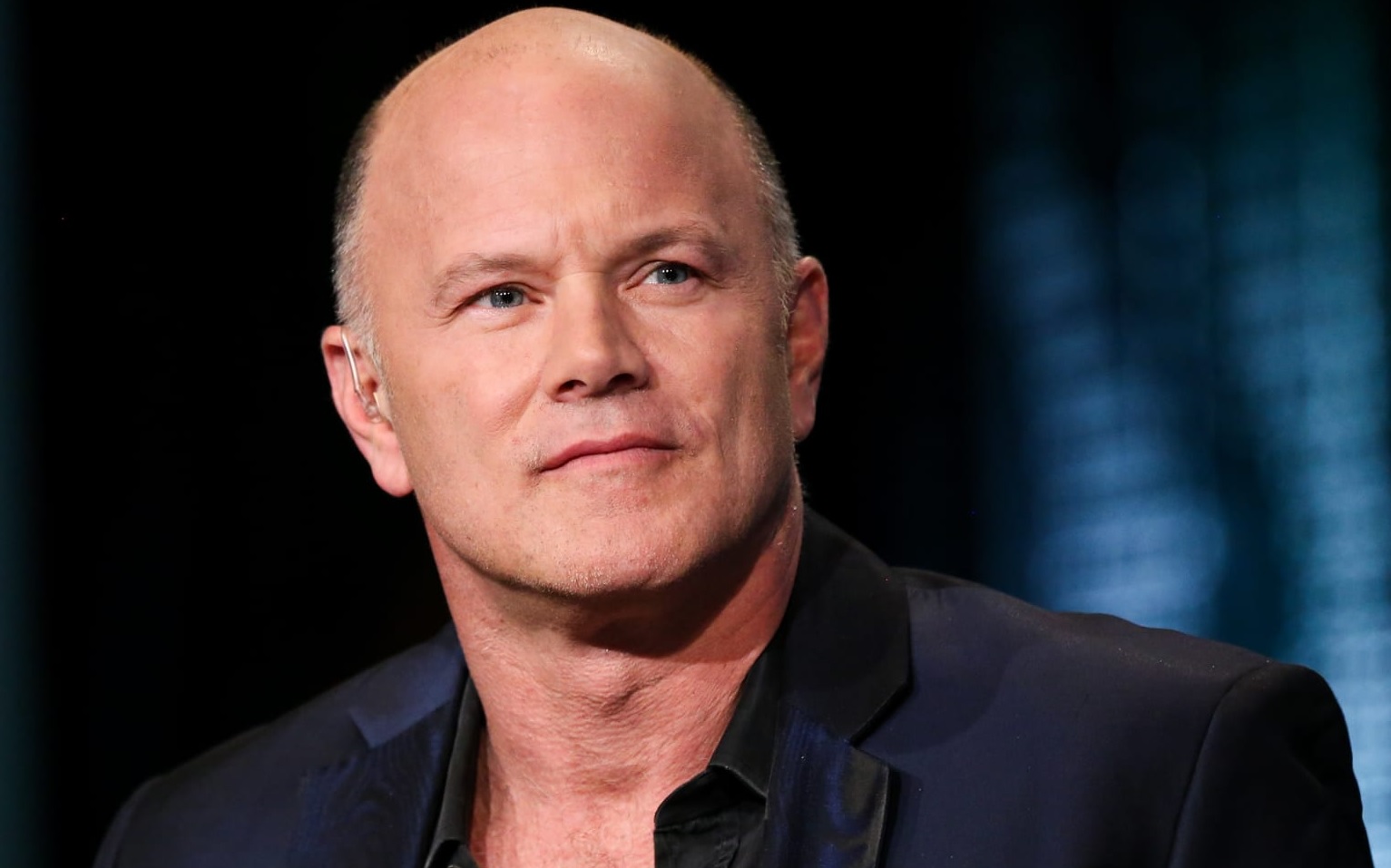

- Yesterday, Galaxy Digital reported a loss of $ 111.7 million in the first quarter due to unrealized losses on crypto holdings

- Mike Novogratz expects that the volatile and tested crypto markets will continue in the next quarters

The fintech and wealth management company Galaxy Digital report on Monday, that it had recorded a loss in the first quarter of the year. The financial services company explained that the downturn was largely due to the price volatility of the crypto markets. In particular, Galaxy Digital said that it recorded a net loss of $ 111.7 million for the quarter ending March 31, which nullified the total profit of $ 858.2 million recorded in the first quarter of the previous year.

It was not all bad, or rather, it would have been worse if it had not been for the investment banking and mining activities. Galaxy Digital announced that it recorded an eight and five times higher net total result for these respective strategies than in the same period last year. The company’s mining division reported a net profit of $5 million and is now on track to reach 2,500 petahashes per second this year.

“The decrease was primarily due to unrealized losses in digital assets and investments in our trading and principal investment businesses, partially offset by profitability in our investment banking and mining businesses and lower operating costs.”, says the report.

The company’s asset management arm, Galaxy Digital Asset Management (GDAM), posted total assets under management of $2.7 billion, a 5% decrease from the previous quarter. However, the figure also represents more than twice the value of assets held in the first quarter of 2021 – $ 1.27 billion.

It gets worse before it gets better

The leading digital asset, Bitcoin, is currently recording prices that are more than 50% below its all-time high, a continuation of the trend that brought Galaxy Digital losses in the first quarter. During a yesterday Conference call commenting on the results, Novogratz insisted that the joint movement of the Nasdaq and crypto markets will have a lasting impact in the coming quarters before the markets become stable again.

“Crypto is likely to trade in correlation to Nasdaq until we reach a new equilibrium. My instinct tells me that there will be even more damage, and that trading will be done in a very troubled, volatile and difficult market for at least the next couple of quarters before people get a sense that we have reached a balance“, he noted.

However, CEO Mike Novogratz remains unimpressed by the market movement and points to the long-term potential of this market area. Novogratz insists that even more institutional adoption is imminent, and he promised further investment in digital finance.